The bankruptcy cost source of financial crisis cost effect savings in M & A is on the brink of bankruptcy enterprises and saving, saving in measurement of financial crisis cost, because the volume of cash flow in enterprise merger and acquisition time, so the savings are present, there is no need for discount.

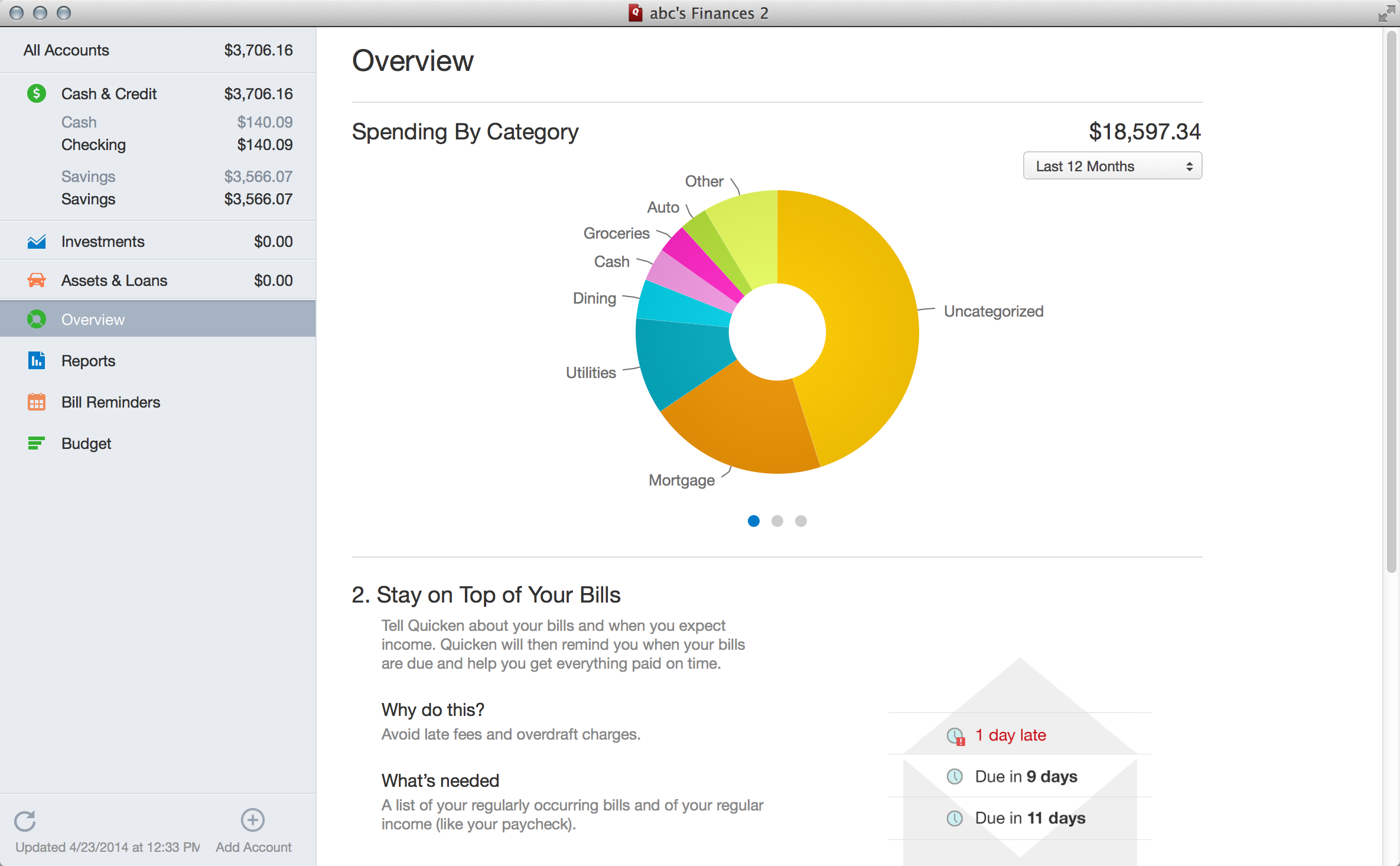

DOWNLOAD QUICKEN 2015 HOME AND BUSINESS FOR MAC

The financial synergy quickbooks download for mac effect The financial synergy effect Measurement of financial crisis to save the cost effect

DOWNLOAD QUICKEN 2015 HOME AND BUSINESS FREE

The problem about the discount rate, theReasonable tax avoidanceThe effect produced by the cash flow basically determined, so the risk free rate as the discount rate. Second, when X<-Y, that is after the merger of enterprises in pre tax profit was not enough to offset the amount of loss due to the target enterprise, the provisions of the Chinese tax law can make up the loss for 5 years, as long as no more than 5 years, the value of M & a tax saving effect is formed for the annual expected loss compensation and the amount and the present value the income tax rate of the product.

If the enterprise after acquisition of pre tax profits for X, mergers quickbooks download and acquisitions business (enterprise) pre taxProfitFor the -y, two enterprise income tax rate is t, the value of corporate mergers and acquisitions of Va, enterprise M & a value for Vb, are: first, when X>-Y, that is after the merger of enterprises in pre tax profits to make up for the target of the enterprise loss amount, so M & a tax saving effect form the value is: X * t.

According to the provisions of the income tax law of China: "be merged items before the merger of the enterprise income tax shall be borne by the merger of enterprises, the losses of the previous year, if not more than the legal remedy period, can be combined by the enterprise to continue in accordance with the provisions in the years with the merged enterprise income tax assets related to compensate for".

0 kommentar(er)

0 kommentar(er)